How Does Dental Insurance Work?

While dental insurance has a monthly premium like health insurance, many plans have a coinsurance structure. That is why when researching dental insurance plans for yourself and your family, you may want to consider how much coverage you might need.

Typically, PPO plans use a 100/80/50 coinsurance structure. Here is how that breaks down:

- 100% for preventive care including cleanings, exams, and X-rays

- 80% for basic procedures, such as fillings

- 50% for major procedures, such as crowns and dentures

Keep in mind, no two dental plans are alike. However, there are two main choices:

1. A medical plan that includes dental benefits (convenient, but may have coverage limitations)

2. A stand-alone dental insurance plan (more flexibility, more coverage options)

Some of the benefits of a stand-alone dental plan can include no dental insurance waiting periods so that you can take care of your dental health right away. Many stand-alone dental plans also include low deductibles and no copays for preventive care.

Know the Difference Between Basic Dental Plans and Full Coverage Plans

Most dental insurance plans cover the costs of preventive care, including routine exams, cleanings and x-rays. Some may also offer coverage for certain basic restorative services like fillings, but you pay more out of pocket.

While full coverage dental plans do not cover 100% of the costs, they do cover preventive care and a broader range of basic and major procedures.

Coverage may include:

- Crowns, root canals, and surgical extractions

- Dentures, dental implants, and veneers

- Braces and other orthodontic treatments

What Does Dental Insurance Cost?

Most Americans pay about $360 a year for dental insurance.1 That amounts to between $15 and $50 a month for a dental insurance plan. Depending on your state and how much coverage you want included in your plan, rates will vary.

To balance the best coverage with your budget, keep in mind all the costs involved in your plan:

Premium – what you pay monthly for your plan

Deductible – what you may need to pay before the plan pays

Copay – what you pay with every visit to a dentist

Coinsurance – the percentage of costs you pay after you meet your deductible

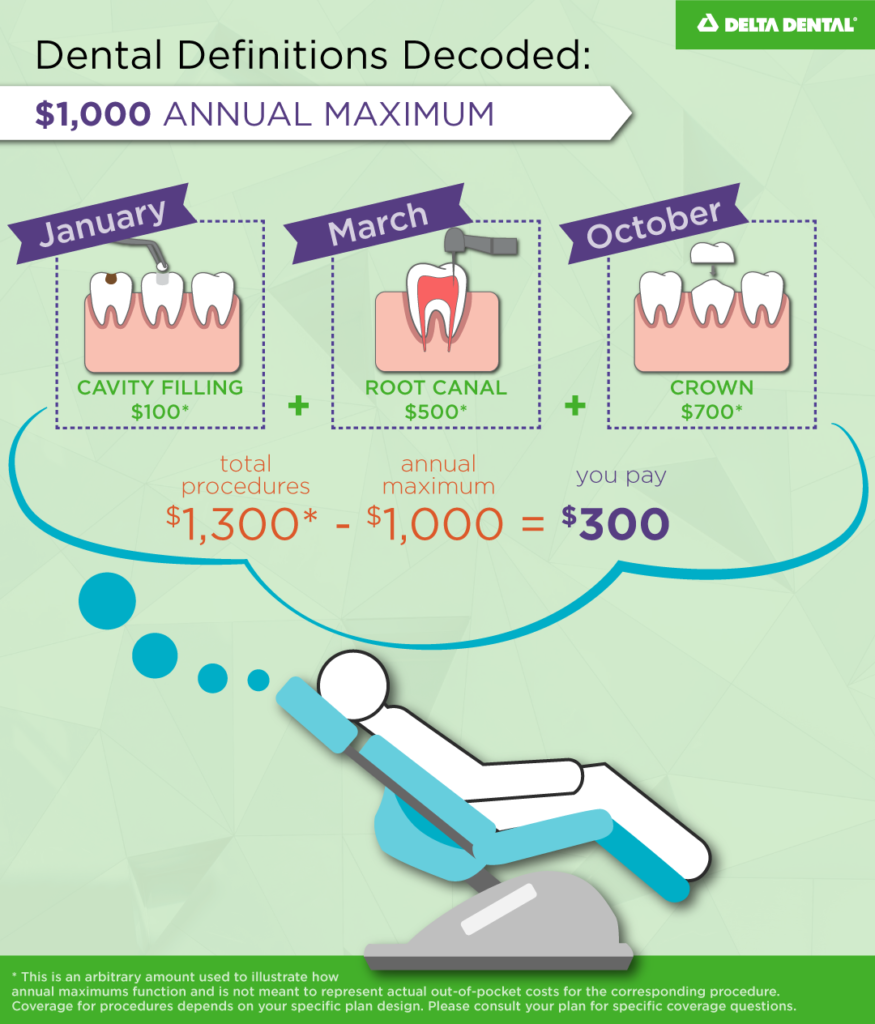

Annual maximums – the most your plan will pay for coverage in a plan year

Compare Coverage And Dental Insurance Networks

Dental insurance plan networks vary by the availability of dental providers. Some plans offer broad networks, others are more restricted, but may cost less. Consider what type of dental insurance plan network meets your coverage needs.

Preferred Provider Organization (PPO)

Just like health insurance, PPO dental insurance provides a list of preferred dentists within the plan network. You can go out of network if you do not mind paying extra for a favorite dentist.

Dental Health Maintenance Organization (DHMO)

DHMOs provide a network of dentists that have agreed to set dental insurance rates, including copays. You avoid all the cost guesswork with a DHMO, but you are limited to in-network dentists. The best part is that you do not have an annual benefit maximum or a deductible. Some procedures have zero out-of-pocket costs.

Indemnity Or Fee-For-Service Dental Plans

Fee-for-service dental plans provide a broad network of dental providers. You pay a percentage for a specified dental service — the plan pays the rest. The percentage you pay depends on the procedure.

Dental insurance is a contract with an insurance company that helps cover the cost of treatments to your teeth and gums. Instead of you paying 100% of the cost out-of-pocket, dental insurance pays a percentage and you pay the rest. Many people get dental insurance through their employer, but you can buy an individual or family dental insurance policy directly from dental insurance companies.

Explore Dental

Explore dental plans that are easy to smile about

Humana’s dental plans are budget-friendly and some offer no waiting period. Shop plans and prices in your area today!

HampshireNew JerseyNew MexicoNew YorkNorth CarolinaNorth DakotaOhioOklahomaOregonPennsylvaniaRhode IslandSouth CarolinaSouth DakotaTennesseeTexasUtahVermontVirginiaWashingtonWest VirginiaWisconsinWyomingAge *Shop dental plans

How does dental insurance work?

Like health insurance, dental insurance works by sharing the costs of dental care in exchange for a premium you pay. You may also have to pay deductibles, copays and other costs, but the details vary from plan to plan. Here are some common terms of dental insurance plans:

Premiums

A premium is what you pay your insurer in exchange for coverage. Premiums are typically billed monthly, but some policies may collect them semiannually or annually. A typical premium may be $20–$50/month for an individual or $50–$150/month for a family based on the type of coverage.1

Deductible

A deductible is the amount you pay toward certain dental expenses before your insurance kicks in. For example: if you have a $1,000 deductible, you pay the first $1,000 of covered services and then a fixed amount (ex. $20) for covered services after the deductible is met. Deductibles typically reset after 12 months.

Coinsurance

Coinsurance is a payment you may be responsible for after you meet your deductible. For example: if your dental plan pays 70% of the cost, your coinsurance payment is the remaining 30% of the cost.

Annual coverage maximum

An annual maximum is the limit your dental insurance will pay toward the cost of dental treatment in a plan year. For example: if your annual maximum is $2,000 and your plan has already paid $2,000 in the first 6 months, you’re responsible for 100% of the costs for the remaining 6 months.

In-network vs out-of-network

A network is a group of dentists who have agreed to provide care based on a plan’s terms and conditions. If you choose an in-network dentist, you’ll typically pay less for treatment. If you choose an out-of-network dentists, you could pay higher deductibles, copays and coinsurance.

Reimbursement

An insurance reimbursement is the money your insurer pays to a dentist to cover the expenses of the services provided. Typically, the payment occurs after you receive a medical service, which is why it is called reimbursement.

What does dental insurance cover?

There are 3 common categories of dental insurance: preventive, basic and major. Many plans take the 100-80-50 approach to coverage, which means preventive care is covered at 100%, basic care is covered at 80% and major care is covered at 50%. Here’s a closer look what dental insurance covers :

Preventive care

Preventive care aims to “prevent” wear and tear, gum disease and tooth loss. Routine visits allow your dentist to examine your mouth, jaw and neck to identify problems and treat them early. Common services covered under preventive care include bi-annual cleanings, oral screenings and routine X-rays.

Basic care

Basic care treats minor-to-medium damage that has already happened, like toothaches and gum issues. Common services covered under basic care include fillings , tooth extractions , root canals and gum disease treatment .

Major care

Complex dental work, including surgical procedures, are typically classified as major dental care. These services can range from crowns and implants to dentures and oral surgery.

What does dental insurance not cover?

Most dental insurance plans don’t cover cosmetic procedures (teeth whitening and veeners ) or orthodontic treatments (dental braces ). Some policies also don’t cover pre-existing conditions like missing teeth that were lost or damaged before receiving insurance.2

How much does dental insurance cost?

Similar to what each plan covers, the cost for dental insurance will be different for each policy. Factors that can affect how much you pay for dental insurance include:3

- Where you live

- Your age

- Copay

- Coinsurance

- Annual maximum benefit

Can I buy dental insurance without health insurance?

Yes, you can buy dental insurance without health insurance. When you purchase a health insurance plan, it doesn’t automatically include dental coverage. Dental insurance is separate from health insurance.

You can buy dental insurance anytime of the year and from any insurance provider. Before deciding, be sure to research your options to find the best coverage for you and your family.

What’s the difference between an HMO plan and PPO plan?

A health maintenance organization (HMO) plan and a preferred provider organization (PPO) plan work the same for dental insurance as they do for health insurance. Here’s a quick definition of each:

Dental HMO plans

Dental HMO plans typically cost less than other dental insurance plans, with lower monthly premiums and less out-of-pocket costs. With these types of plans, you’ll only get coverage when you visit dentists and other specialists who are in the HMO network.

Dental PPO plans

Dental PPO plans tend to cost more than HMO plans, with higher monthly premiums and out-of-pocket costs. The higher cost is in exchange for the flexibility to use dentists and providers both in and out of network.